Employer & Group Pharmacy

Cutting Costs with Medical and Pharmacy Coverage

It pays off when medical and pharmacy insurance work together. Integrating medical and pharmacy plans saves you money. It also offers the convenience of one card backed by the largest network in the nation and nearly 80 years of experience.

Medical & Pharmacy Savings

Is it worth it to integrate?

Two studies published in the Journal of Managed Care & Specialty Pharmacy showed the effects of carving in pharmacy coverage on both utilization and cost.1,2

The studies found:

3.7%

lower medical costs

$8.73

reduction per member per month

12-17%

lower costs for members with 1 of 7 chronic conditions

Pharmacy Benefits

Why It's Better to Integrate Your Coverage

Pharmacy Benefits for Employers

We provide head-to-toe coverage, and your employees get everything they need in one place, supported by one team that's just a click or call away. That makes it easier for your employees to get the care and drugs they need when they need them.

- One ID card, app, website and specialty pharmacy

- All resources and drug lists in one place

- Large pharmacy network with convenient locations

- Cuts costs while being easier to use

Pharmacy Benefits for Employees

Imagine having everything you need for insurance in one place—and saving money, too. We work with you to make sure your employees get the health support they need while cutting extra costs and making coverage as seamless as possible.

- One vendor, eligibility file, invoice and administrative team

- Transparency at all levels

- Integrated data and more personalized conversations

- Easy, integrated reporting on spend and opportunities

Ask about a pharmacy plan

You can save money and make life easier for your members when you combine your medical and pharmacy coverage.

More Pharmacy Savings

Results you can see

Our two-year analysis found health plans with fully integrated chronic care management, pharmacy, medical and Advanced Specialty Benefit Management typically save more than $344 annually per member per year on medical costs compared to non‑integrated options.

6.5%

lower medical costs for integrated vs. non-integrated members

$344

average medical savings per member per year

Contact Us

Have questions about a plan? We’re here to help

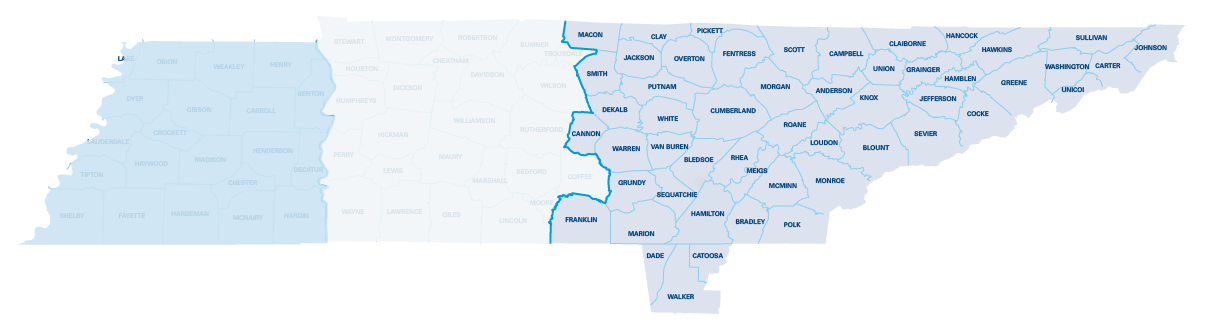

West & Central

East

- ${title}${badge}